Data science, News

Comparing ESG ratings of Swiss companies in 2024

13 Aug 24

In today’s business world, ESG criteria have become an important benchmark for evaluating companies. ESG stands for Environment, Social and Governance. These criteria help to evaluate the sustainable and ethical performance of companies.

For example, the environmental aspect can include how a company deals with its CO₂ emissions or how it manages its resources. The social aspect relates to how a company treats its employees, customers, and society, such as fair working conditions and social commitment. Governance includes aspects such as transparent business processes and ethical management behavior. This ESG data plays a significant role in the calculation of ESG scores by rating providers.

Three years ago, we analyzed the assessments of various ESG rating providers. This article revisits the analysis and uses current data to examine whether the ratings still differ and how ESG scores have developed over the last few years.

Data basis

For the following analyses, we have collected the ESG scores (as of July 30, 2024) of around 130 companies listed on the Swiss stock exchange from the rating providers Sustainalytics (Morningstar), MSCI, Standard & Poor’s (S&P) and the London Stock Exchange Group (LSEG, formerly Refinitiv). We only use publicly available ESG score data to ensure the greatest possible transparency.

However, this approach means that our comparisons are limited to those companies for which data is available from the aforementioned rating agencies. Due to different coverage and data availability, the overlaps are sometimes only small, which reduces the number of comparable companies.

ESG rating comparison

The rating agencies work with different rating scales, which makes direct comparisons difficult. In order to make these scales statistically comparable, we do not use the actual ratings of the companies, but their rankings within a rating provider. This neutralizes possible differences in the content of the ratings and enables an objective comparison.

More detailed information on ESG and the methodology of the analysis can be found in our previous blog post (available in German).

In the charts, the ranks are defined on the axes. The lighter the area in which a company is placed, the greater the agreement between the rating providers. This visualization helps to quickly and clearly recognize in which cases there is a high consistency between the ranks and where there are major deviations.

LSEG vs Sustainalytics

Fig. 1: ESG ranks comparison LSEG vs Sustainalytics.

This comparison assesses 125 companies. There are clear differences, particularly among the “frontrunners”. For example, UBS is ranked in the top 10 by LSEG, while the big bank does not even make it into the top 100 in the Sustainalytics ranking. It is also noticeable that clusters form, i.e. groupings of companies that are rated differently to a similar extent.

One such cluster can be seen in the top left of the chart with Cicor, Intershop, etc. Another cluster can be seen at the bottom center and includes Orior, BKW, Sensirion, LLB, etc. These cluster formations could indicate that different factors are considered in the rater’s valuation models. Overall, the graph shows no clear trend of agreement, which is also reflected in a correlation coefficient of 0.35.

LSEG vs S&P

Fig. 2: ESG ranks comparison LSEG vs S&P.

This comparison includes 67 companies and shows greater consistency in sustainability valuation, which is reflected in a correlation coefficient of 0.70. Both providers rate UBS, Roche, and ABB as sustainable and place Intershop, Phoenix Mecano, and Peach Property at the lower end of the rankings. There is an extreme discrepancy with Sika, which is ranked in the top 15 by S&P, but occupies one of the bottom places by LSEG.

Sustainalytics vs S&P

Fig. 3: ESG ranks comparison S&P vs Sustainalytics.

The comparison of Sustainalytics’ and S&P’s ESG score ranks also includes 67 companies. As in the first comparison, there is no clear trend of agreement. UBS, Roche, Intershop, and Peach Property have quite different ratings. On the other hand, Tenemos, Ypsomed and Phoenix Mecano show a high degree of agreement. The correlation coefficient here is 0.33.

These comparisons show that the level of agreement in the sustainability rating still varies greatly between different rating providers. The low correlation coefficients of the first and third evaluations (0.35 and 0.33) indicate different evaluation approaches and focuses of the agencies.

Developments in ESG scores

In the second part, we analyze how the ESG scores of providers have changed over the last few years. We look at whether the score has changed and in which direction.

Fig. 4: Changes in ESG scores since 2021.

The evaluations show a similar picture: more than half of the companies analyzed have improved in terms of ESG. Interestingly, however, the changes in ESG scores show a low to negative correlation between the individual providers.

Correlations of the changes:

- – Between MSCI and Sustainalytics: 0.22.

- – Between MSCI and S&P: 0.25.

- – Between S&P and Sustainalytics: -0.15.

This means that companies whose score has improved with one provider do not necessarily show this development in the rating of another provider. In some cases, companies that have shown a positive development with one provider have even experienced a deterioration with another provider. These correlations illustrate the differences in the assessment methods and criteria of the various rating agencies.

Developments in the S&P scores

As the developments at S&P appear balanced (15 negative, 16 positive developments), we take a closer look at them. We compare the actual scores, as these now come from the same provider and are therefore comparable.

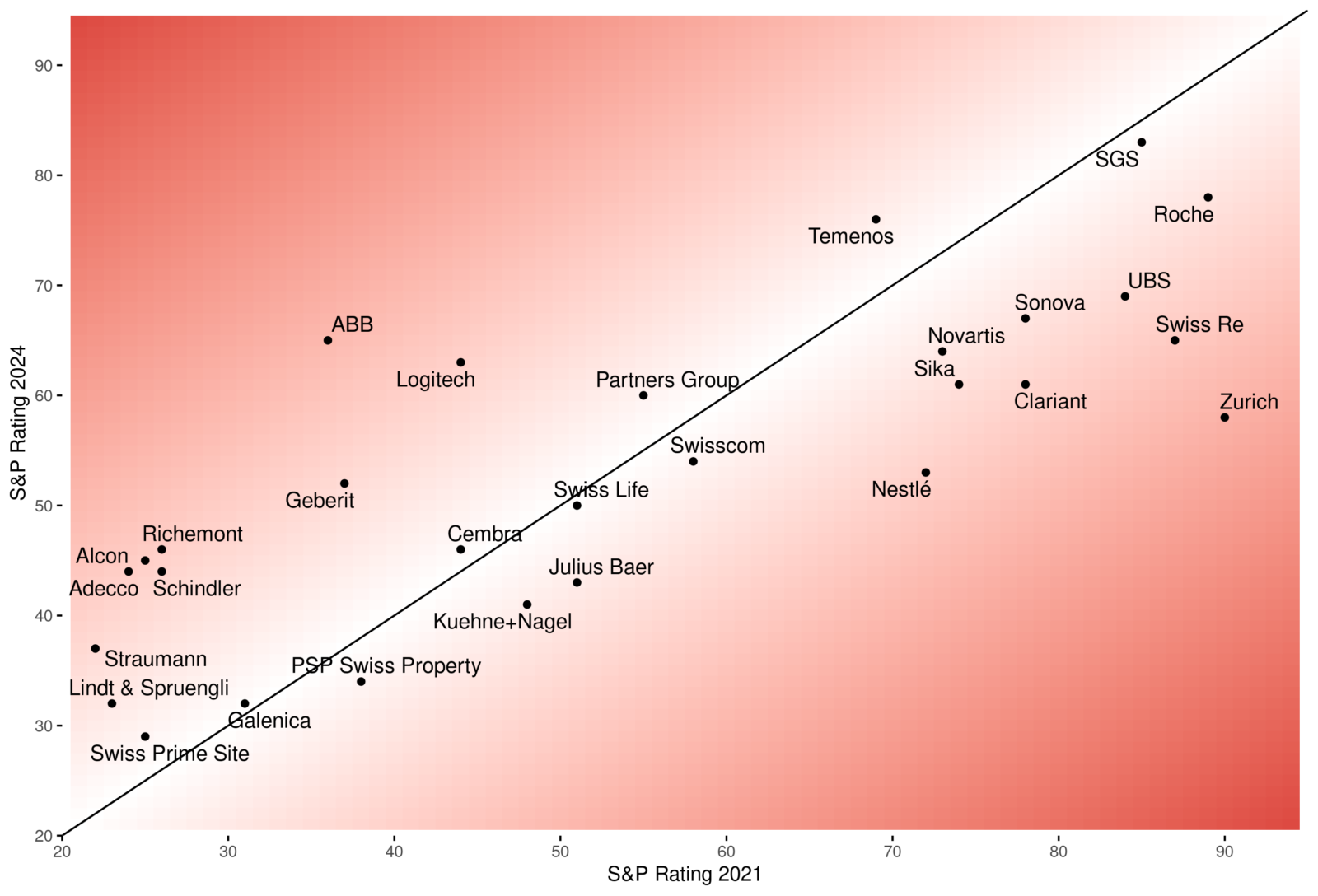

Fig. 5: Development of S&P ESG valuations.

In the analysis, we can see how S&P’s ESG scores have changed over the years. For companies below the black diagonal, S&P has reduced the ESG score, while companies above the diagonal have improved their score.

It is striking that nearly all companies that achieved a score over 70 in 2021 were revised downwards in 2024. The opposite is true for lower ESG scores, with many being revised upwards.

The reasons for this development are not immediately obvious and could be due to various valuation factors. An in-depth analysis would be necessary to understand the exact causes of these score changes. It is possible that S&P’s rating models have changed over time or that new rating criteria have been introduced. Changes in data availability and quality could also play a role.

However, without a detailed investigation, it remains unclear what specific factors have caused these shifts.

Summary

The analysis of the ESG ratings of Swiss companies clearly shows that there are still considerable differences between the assessments of the various rating providers.

While some providers show greater consistency in their ratings, different rating models and criteria often lead to contradictory results.

Developments in ESG scores over recent years also underline that assessment methodologies remain dynamic and complex, making it difficult to assess companies’ sustainability performance consistently.

These differences emphasize the need to look critically at ESG ratings and evaluate them in a broader context.

Do you have data that you would like to have analyzed and gain valuable insights, then please contact us (it does not have to be ESG data).

share